Business Insurance in and around Auburn

One of the top small business insurance companies in Auburn, and beyond.

Almost 100 years of helping small businesses

Help Protect Your Business With State Farm.

As a business owner, you have to handle all areas of business, all the time. The details can be overwhelming! You can maximize your efforts by working with State Farm agent Jamie Hefty. Jamie Hefty can relate to where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your worries and frees you to focus on growing your business into the future.

One of the top small business insurance companies in Auburn, and beyond.

Almost 100 years of helping small businesses

Surprisingly Great Insurance

If you're looking for a business policy that can help cover computers, extra expense, and more, State Farm may be able to help, just like they've done for other small businesses for almost 100 years.

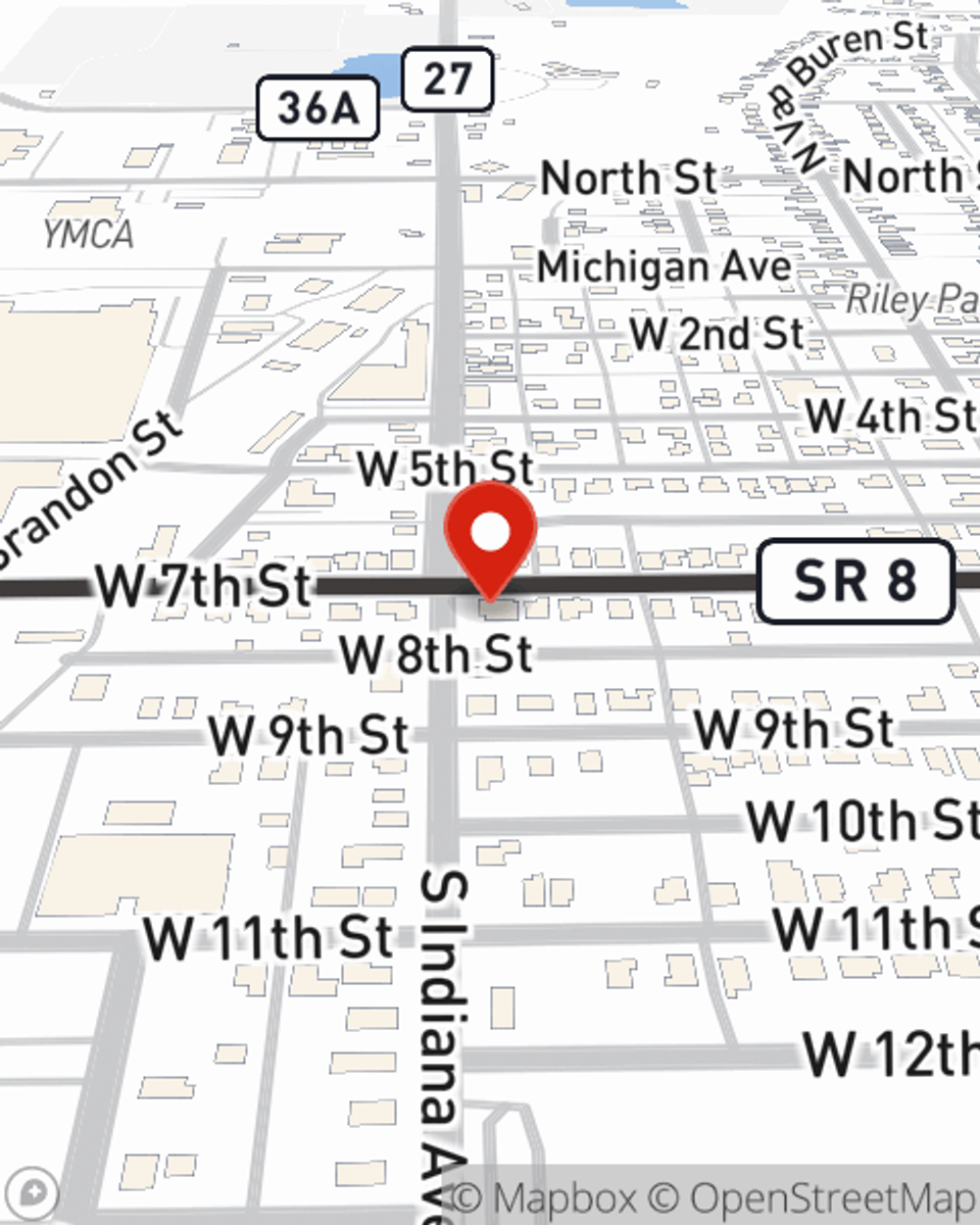

At State Farm agent Jamie Hefty's office, it's our business to help insure yours. Visit our excellent team to get started today!

Simple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Jamie Hefty

State Farm® Insurance AgentSimple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.